The bond market has been on a roller coaster ever since President Trump revived his pro-tariff playbook. But with the White House now pushing a deficit-expanding tax-and-spend bill through Congress, Wall Street’s concern over U.S. debt has officially hit a boiling point.

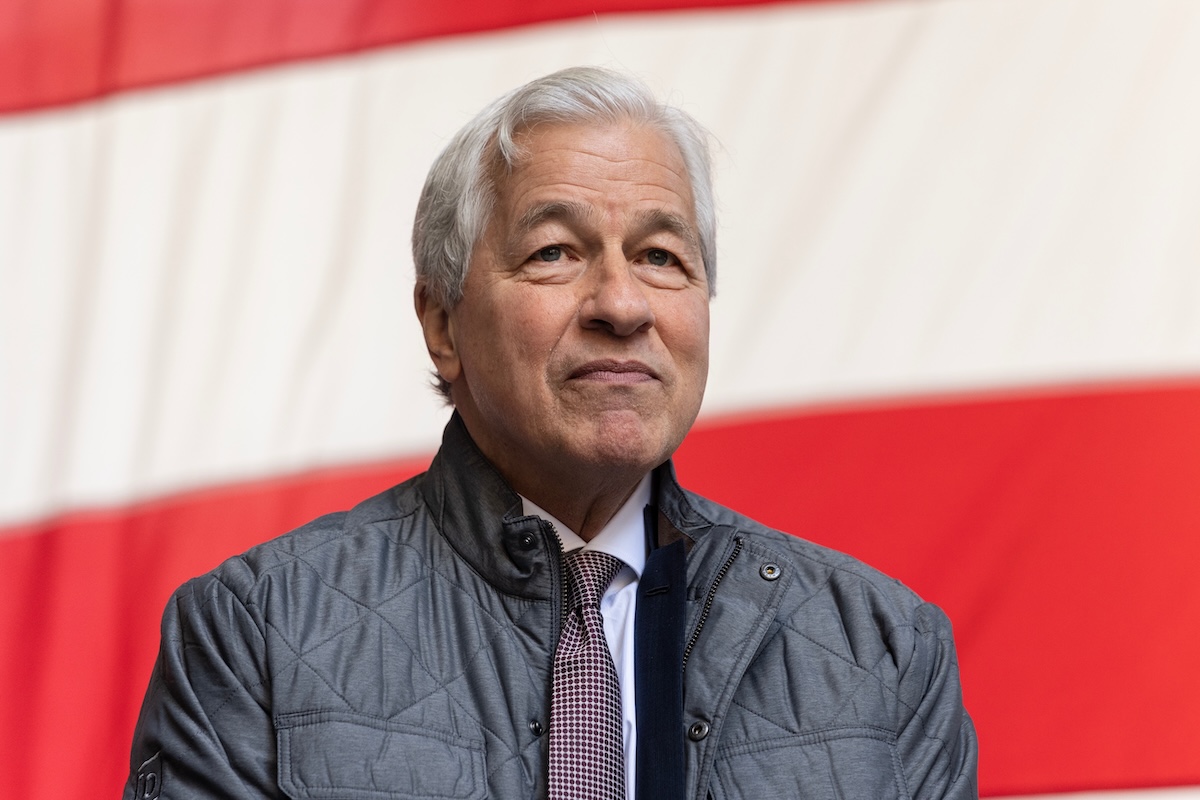

Speaking at an event organized by the Ronald Reagan Presidential Foundation last week, JPMorgan Chase CEO Jamie Dimon didn’t mince words. “You are going to see a crack in the bond market. OK, it is going to happen,” he said. “And you are going to panic.”

Dimon said he’s already raised the alarm with top regulators, citing mounting risks from exploding deficits, political dysfunction, and waning foreign demand. “We’re spending like drunken sailors,” he added. “It’s a matter of time before the market loses faith.”

That time may already be here.

Yields surge, confidence falters

In response to Trump’s escalating trade rhetoric and the proposed “Big, Beautiful” infrastructure bill — which is projected to add trillions to the deficit — investors have been pulling back from long-term U.S. debt.

The result was a sharp spike in yields across the whole Treasury curve. The 10-year yield is now hovering near 4.8%, up nearly 100 basis points since the start of the year.

Many analysts warn that the 5% level could be a “psychological breaking point” for markets where borrowing costs will be high enough to set off broader ripple effects.

“If yields keep pushing higher, you’ll start seeing pain in mortgages, auto loans, and credit cards and that’s how recessions start,” said Torsten Slok, chief economist at Apollo Global Management.

Not just Trump's problem

It’s not just a domestic problem. The Institute of International Finance (IIF) says that U.S. fiscal policy now threatens to destabilize global bond markets.

“The implications of rising U.S. debt levels are not limited to the domestic economy,” IIF economists wrote in a recent report. “They are also likely to trigger significant contagion and spillover effects across global bond markets.”

Bond yields in Germany, France, and the U.K. have already started rising in lockstep with the U.S., reflecting what the IIF calls “deep interconnections through trade and capital markets.”

That means if foreign confidence in the U.S. Treasury market breaks (whether due to political gridlock, excessive deficits, or tariff wars), the shockwaves won’t stop at America’s borders.

Adding to the pressure, the latest Treasury International Capital (TIC) data shows that major buyers like Japan and China have been quietly scaling back their holdings.

“Foreign appetite is drying up,” said Nancy Davis, CIO at Quadratic Capital. “And without it, the U.S. is left to fund its own deficits in a rising-rate environment. That’s a dangerous game.”

Your email address will not be published. Required fields are markedmarked