The future of commercial real estate in the United States is shifting away from traditional office space and toward data centers, reflecting both the rise of AI and the growing need for vast computing power to power it.

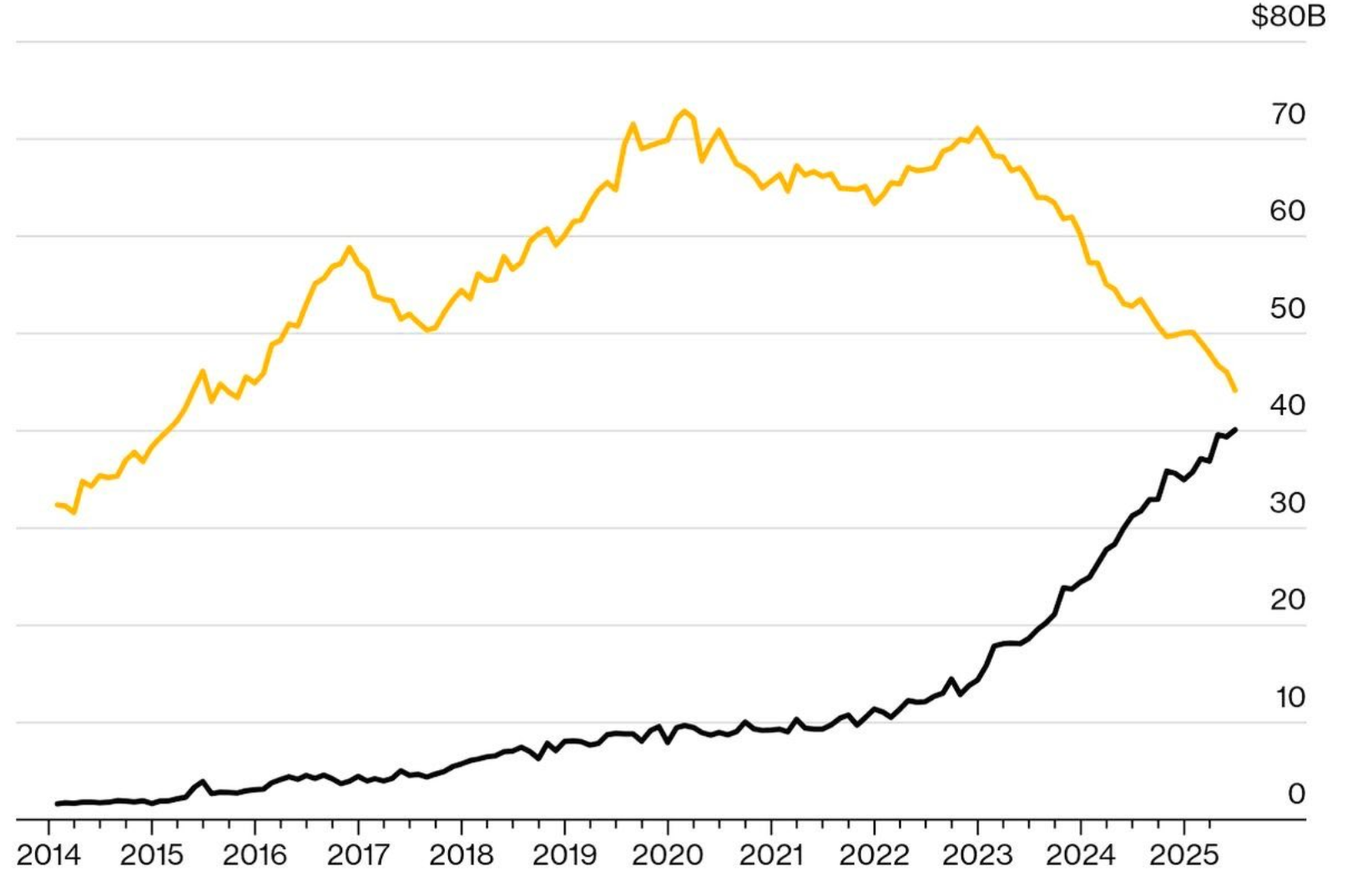

By June, U.S. spending on data centers had surpassed $40 billion, compared with $44.17 billion on general office space, according to Census Bureau Data.

For the first time, data center expenditures were on track to outpace office spending “in the coming months.” But the bigger story lies in the trend.

In 2021, data center construction was valued at under $10 billion, while office space exceeded $65 billion. Since then, the two categories have moved in opposite directions. Office spending has steadily declined, while data center investment has more than quadrupled.

Peter Mallouk, CEO of Creative Planning, called this convergence “the two biggest real estate trends in one graph.”

The two biggest real estate trends in one graph. pic.twitter.com/vFNkSe62mt

undefined Peter Mallouk (@PeterMallouk) August 12, 2025

The growth in construction mirrors the surge in energy demand from data centers, now accounting for 5% of total U.S. power consumption, according to The Kobeissi Letter, citing McKinsey and Apollo. That share is projected to exceed 10% by 2030.

The figures showed that data centers will consume more than 10% of the U.S. energy supply by 2030.

“This increase has been driven by the rapid adoption of digitalization and AI technologies,” The Kobeissi Letter noted. “Energy will soon be the AI bottleneck.”

AI is reshaping the economy and investments

For investors, the real opportunity isn’t in owning data centers themselves but in the technologies and applications those facilities enable.

According to Paul Kenney of Syntax, AI-related hardware and software have steadily increased their share of the S&P 500 Index since around 2020. By 2024, his analysis estimated that roughly 8% of the index was tied to AI-driven product lines.

That share has likely grown in 2025, helped by Nvidia alone, which now represents more than 8% of the S&P 500’s total market capitalization.

Beyond individual weightings, Wall Street’s “Magnificent Seven” tech leaders — Nvidia, Meta, Amazon, Alphabet, Microsoft, Apple, and Tesla — are collectively on track to spend more than $400 billion on AI initiatives this year.

In the short term, these expenditures will be “a tremendous hit on margins,” D.A. Davidson analyst Gil Luria told The Wall Street Journal.

However, if the thesis proves correct, securing an early-mover advantage could be critical to long-term success for companies and their shareholders.

By 2030, AI is projected to add between $4.4 trillion and $15.7 trillion to the global economy, with some forecasts predicting it could boost U.S. GDP by as much as 21% through productivity gains.

Your email address will not be published. Required fields are markedmarked