Antonio Linares, an investor known for investing in Tesla (TSLA) at $13 and Palantir (PLTR) at $7, says Duolingo (DUOL) is his next high-conviction bet despite its $500 price tag.

Duolingo, a gamified language-learning platform, brought in $748 million in revenue in 2024 and is now positioning itself as a disruptor in the $10 trillion global education market.

Linares made his bullish case in a post on X, citing the company’s expanding user base, aggressive use of AI, and strong data infrastructure.

He called Duolingo “the organization that’s most obsessed with education end-customers,” comparing its execution speed and customer focus to companies like Amazon (AMZN), Netflix (NFLX), and Spotify (SPOT).

Linares has earned a reputation for spotting long-term winners early also backing Advanced Micro Devices (AMD) when it traded below $5.

Now, he believes Duolingo is in the early innings of its massive rally.

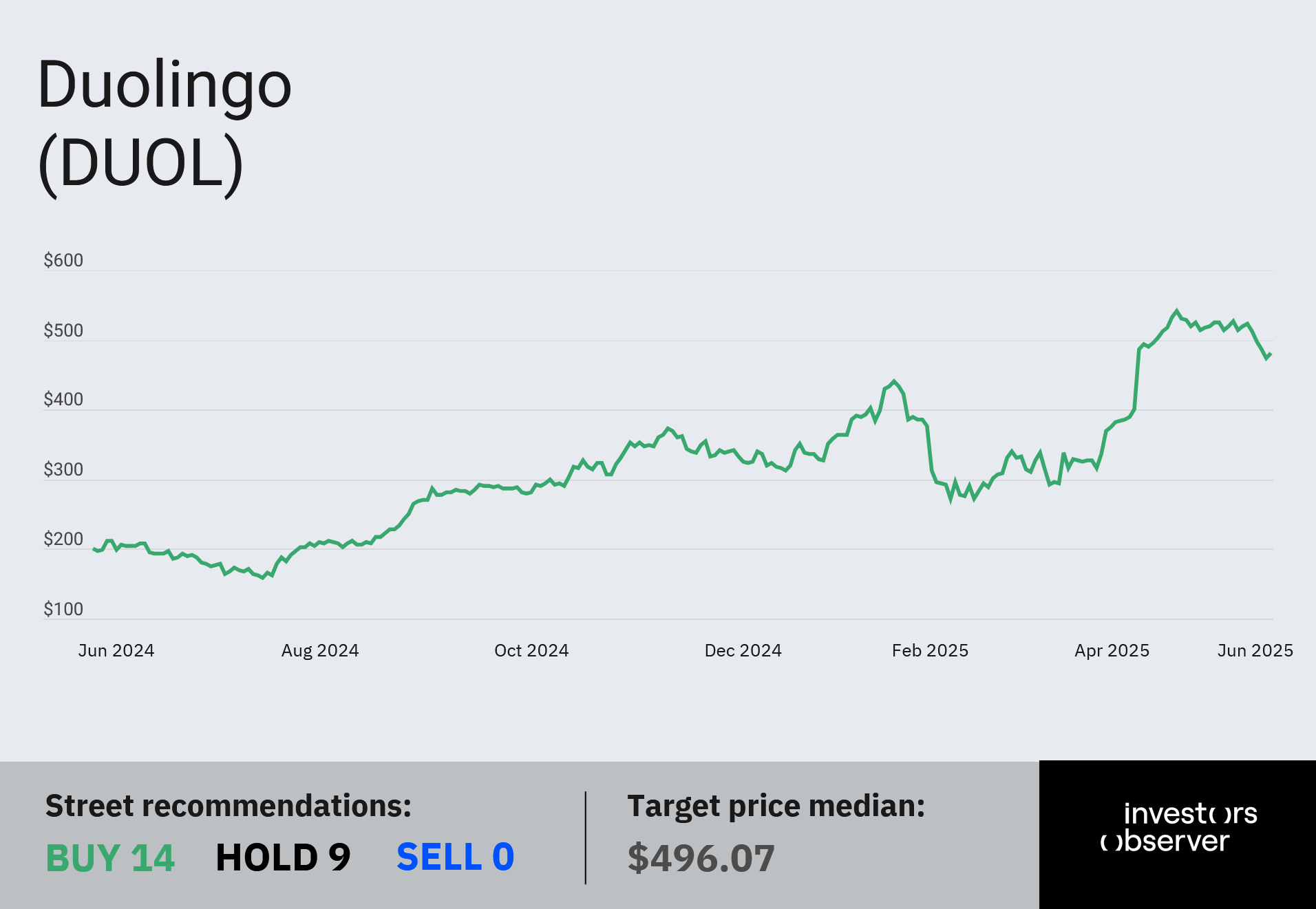

Some investors remain wary of DUOL’s high valuation, and for a good reason. The stock has rallied over 52% this year and more than doubled in the past 12 months.

But Linares points to the company’s improving fundamentals, including fast-growing cash reserves, which he says are outpacing even Palantir and Hims & Hers (HIMS).

Is Duolingo a billion-dollar company in the making?

Fresh off a record 2024, Duolingo is making a strong case for hitting $1 billion in revenue by year-end.

In Q1 2025, Duolingo reported a 38% jump in revenue to $230.7 million, beating expectations. EPS came in at 72 cents, well above the 51-cent forecast from FactSet.

The company’s paid subscriber base just crossed the 10 million mark. Monthly active users rose 33% year-over-year to 130.2 million.

Management now expects full-year revenue between $987 million and $996 million, putting it on the cusp of breaking the billion-dollar barrier.

Wall Street has taken notice. Morgan Stanley recently raised its price target on DUOL, with analyst Nathan Feather noting the company is tapping into a $220 billion addressable market.

If the momentum holds, Linares’ latest bet might not stay “under the radar” much longer.

Your email address will not be published. Required fields are markedmarked