Honeywell (HON) just sealed its second major acquisition in a month, showing that even after getting hammered by Trump’s “Liberation Day” tariffs, the industrial giant isn’t slowing down.

On Monday, the company announced it had completed its purchase of Sundyne for $2 billion in cash. The deal brings a suite of high-spec pumps and compressors used in refining, LNG, and renewable fuels under the Honeywell umbrella.

Sundyne was previously owned by private equity firm Warburg Pincus.

The move comes just weeks after Honeywell added Johnson Matthey’s Catalyst Technologies segment to its Universal Oil Products (UOP) business for $2.4 billion.

That acquisition further expamds Honeywell’s exposure to the refining, petrochemical, and clean fuels value chain.

New year, new me

Both deals feed directly into Honeywell’s post-breakup strategy.

In February, the company announced plans to split into three independent businesses: Aerospace, Automation, and Advanced Materials. The idea is to unlock shareholder value by giving each segment the focus — and cost structure — to stand on its own.

Aerospace brings in about $15 billion a year, Automation about $18 billion, and Advanced Materials roughly $4 billion.

The latter is set to be spun off by the end of this year or early 2026, while the rest of the restructuring will play out in the second half of 2026.

That plan was initiated by activist investor Elliott Investment Management, which disclosed a massive $5 billion stake in the company last November and said the breakup could lift Honeywell’s stock by 75%.

In their Q1 investment letter, Madison Dividend Income portfolio managers John Brown and Drew Justman backed Elliott’s thesis, calling the split a “logical next step.”

“These businesses are likely to have better focus, different levels of capital intensity, and different growth profiles as stand-alone entities,” they wrote.

Madison first bought shares in 2020 and added again in June 2024. They described Honeywell as having a “sustainable competitive advantage” thanks to its scale, high switching costs, long history of innovation, and strong embedded product footprint.

The powers that be don’t buy the shift

Not everyone has been bullish lately.

According to the Wall Street Journal, members of Congress and their families made over 700 trades during the week President Trump unleashed his Liberation Day tariffs. And no stock was sold more aggressively than Honeywell.

The selloff occurred between April 2 and April 8, the day before Trump paused most of the tariffs.

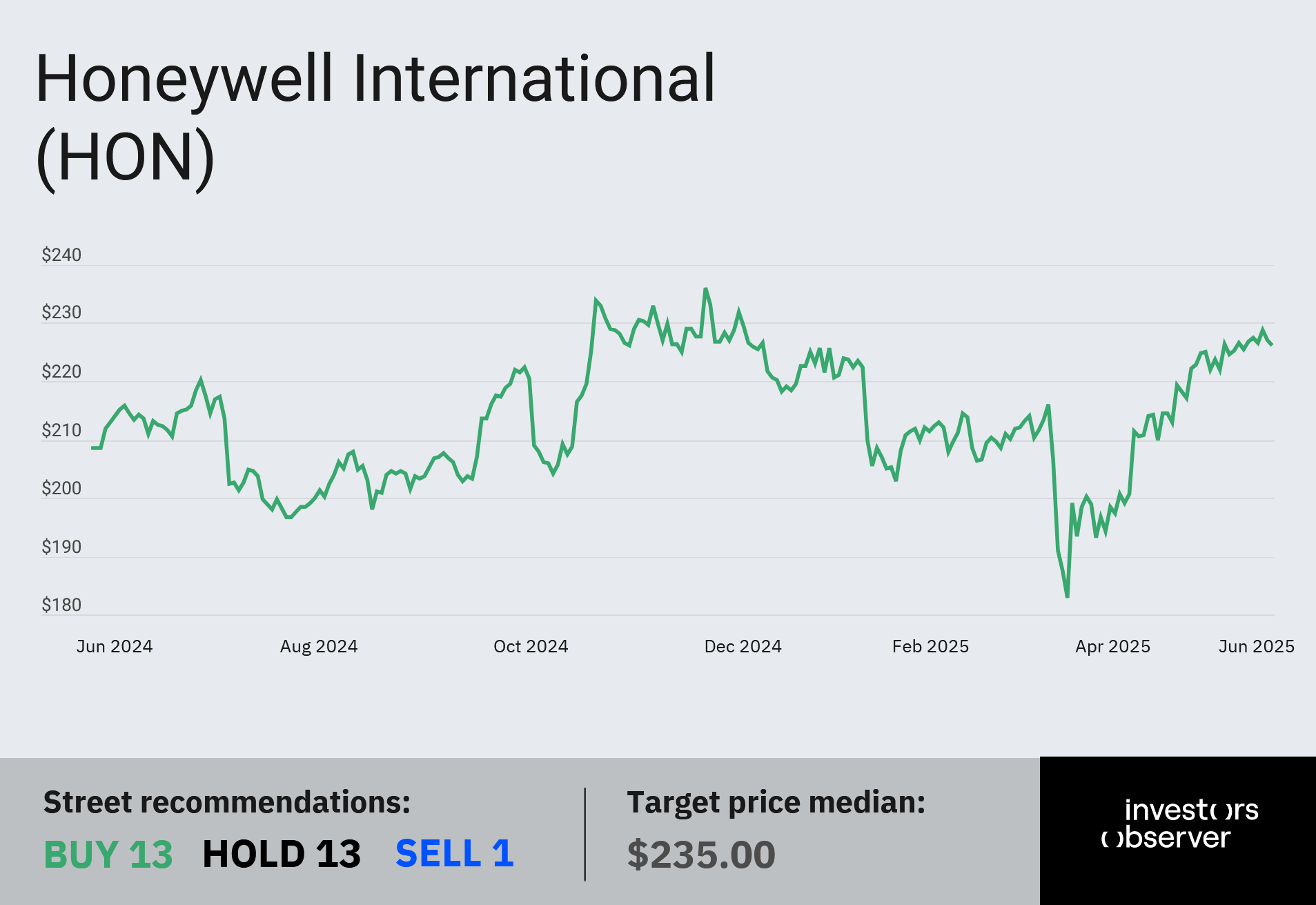

Honeywell’s stock dropped 17% that week alone. Despite the rebound since then, the episode highlighted how quickly political shifts can rattle even the most diversified blue chips.

But with two new acquisitions under its belt and a breakup in motion, Honeywell seems determined to prove it's not just another tariff casualty.

Your email address will not be published. Required fields are markedmarked