Applied Digital (APLD) is starting to look like a comeback story.

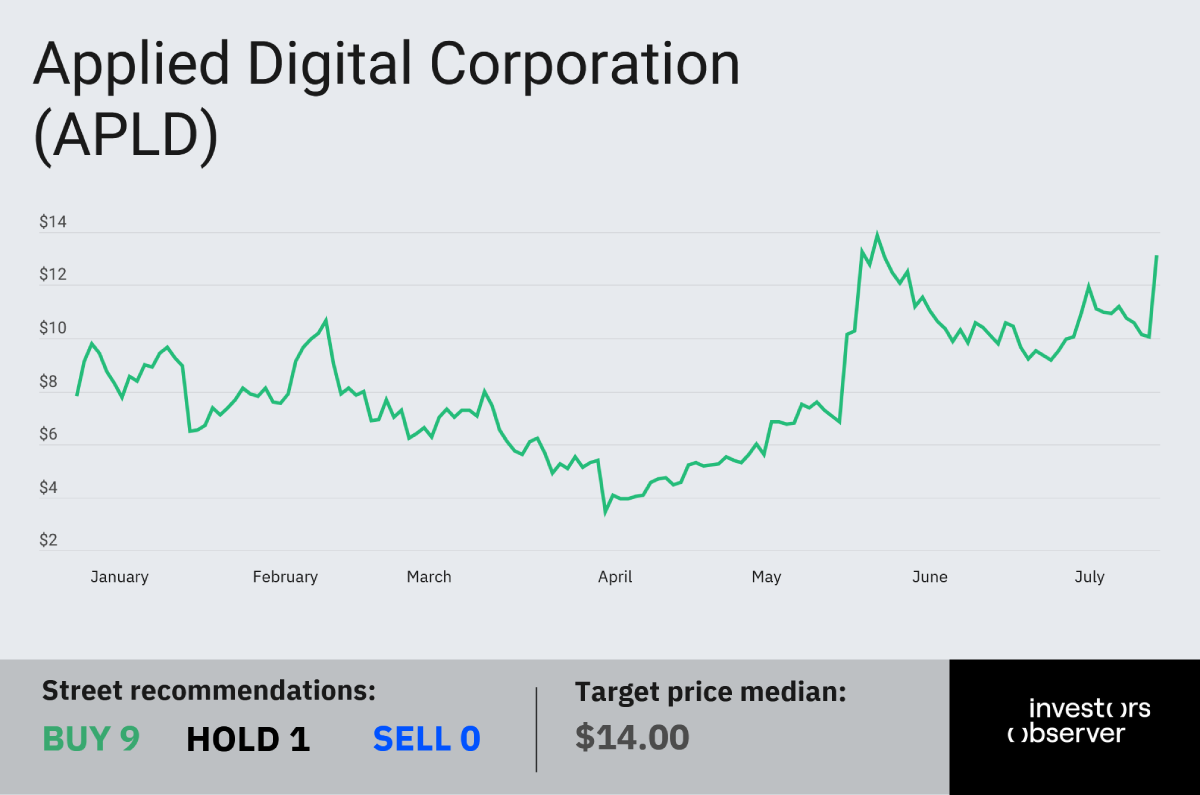

After a brutal 36% drop in April when fiscal Q3 earnings missed expectations and investors questioned its business model, the stock climber 31% on Thursday and is up nearly 72% year-to-date.

Back then, Wall Street wasn’t impressed with the company’s core business.

Data center hosting revenue slipped 7% year-over-year, cloud services revenue plunged 36% quarter-over-quarter, and growth prospects looked shaky.

In response, Applied Digital pulled off a hard pivot. On April 10, the company approved the sale of its cloud services unit, a move designed to streamline operations and focus on its bread-and-butter data center business.

Long term, the plan is to become a real estate investment company renting server space to hyperscalers, and that business model is now starting to pay off.

In its fiscal Q4 report, revenue jumped 41% year-over-year, easily beating analyst estimates.

The turnaround has been fueled by surging demand for data center capacity, including two blockbuster 15-year lease agreements with AI powerhouse CoreWeave (CRWV), announced in June.

Under the deal, Applied Digital will deliver 250 megawatts (MW) of critical IT load to power CoreWeave’s AI and high-performance computing infrastructure at its Ellendale, North Dakota campus. At signing, the contract was expected to generate $7 billion over its lifetime.

That figure just ballooned. Applied Digital said this week that CoreWeave exercised an option for an additional 150 MW, bringing the projected revenue to roughly $11 billion.

CEO Wes Cummins told investors the company is breaking ground on at least one — and possibly two — new campuses by year-end.

Applied is also in “advanced negotiations with an investment-grade North American hyperscaler” and in talks with several others for additional sites both inside and outside North Dakota.

The timing couldn’t be better.

The data center market is forecast to grow from $269.79 billion in 2025 to $584.86 billion by 2032, representing an 11.7% compound annual growth rate, according to recent data. North America currently leads the global market, commanding nearly 39% of the share in 2024.

Cummins argues that Applied has a competitive edge. “

Combined with abundant, low-cost energy and over 200 days of naturally occurring free cooling annually, management believes a 100 MW data center customer could save up to approximately $2.7 billion over a thirty-year period as compared to the current industry data centers in other regions,” he said.

With hyperscalers racing to secure space for AI and HPC workloads, Applied Digital’s data center real estate play might finally be clicking.

Your email address will not be published. Required fields are markedmarked